Wealth Management

Expertise to look after your wealth

JGP Wealth Management was created to serve a select group of clients. In 2007, boosted by our recognized performance in asset management, we launched our wealth management unit.

With a team committed to excellence in the services provided, we act in an independent, objective, and personalized way – prioritizing capital preservation, value generation, and wealth perpetuation.

Why JGP Wealth?

Long-term view and search for consistent returns, combined with capital preservation.

No conflict of interest.

Our only source of compensation is the fee we charge our clients.

Interaction between managers.

The various teams work together to identify opportunities.

Exclusivity

Focus on a select group of clients who share our philosophy.

Services

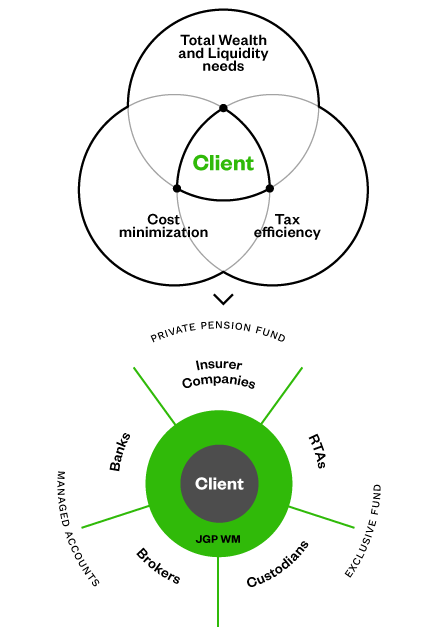

Wealth management is our main pillar. The process begins with a complete understanding of the client’s risk profile and needs, in order to build a unique investment portfolio. We seek to provide investments that maximizes risk-adjusted returns. To this end, we have an open architecture that allows us to build the portfolio with the best asset classes and investment funds available.

Our team is prepared to look after your wealth both in Brazil and abroad, since currency and regional diversification can be a great ally in the long term. JGP’s investment committee has members with complementary backgrounds and extensive experience in the financial market.

Some families rely on the support of more than one manager to look after their wealth. We have a skilled team and proprietary software that consolidates several portfolios into a single report. This work gives us a holistic view, which is fundamental to verifying if the final portfolio allocation is aligned with the family’s return and risk objectives.

This service also helps to evaluate the different service providers and optimize the costs involved by negotiating institutionally with banks, brokers, and other service providers.

Life is dynamic, family structures change, individuals move to different countries and laws are constantly being amended in different jurisdictions. That’s why it’s important to always be aware of whether your investment structure is the right one for your family situation.

We help our clients find the best service providers in each jurisdiction so that the investment vehicles and planning involved are always the most efficient.

These services include the constitution of investment funds, the constitution of companies, and the assistance in the formation of investment committees and wills in Brazil and abroad.

.

Wealth management is our main pillar. The process begins with a complete understanding of the client’s risk profile and needs, in order to build a unique investment portfolio. We seek to provide investments that maximizes risk-adjusted returns. To this end, we have an open architecture that allows us to build the portfolio with the best asset classes and investment funds available.

Our team is prepared to look after your wealth both in Brazil and abroad, since currency and regional diversification can be a great ally in the long term. JGP’s investment committee has members with complementary backgrounds and extensive experience in the financial market.

Some families rely on the support of more than one manager to look after their wealth. We have a skilled team and proprietary software that consolidates several portfolios into a single report. This work gives us a holistic view, which is fundamental to verifying if the final portfolio allocation is aligned with the family’s return and risk objectives.

This service also helps to evaluate the different service providers and optimize the costs involved by negotiating institutionally with banks, brokers, and other service providers.

Life is dynamic, family structures change, individuals move to different countries and laws are constantly being amended in different jurisdictions. That’s why it’s important to always be aware of whether your investment structure is the right one for your family situation.

We help our clients find the best service providers in each jurisdiction so that the investment vehicles and planning involved are always the most efficient.

These services include the constitution of investment funds, the constitution of companies, and the assistance in the formation of investment committees and wills in Brazil and abroad.

.

Investment

process

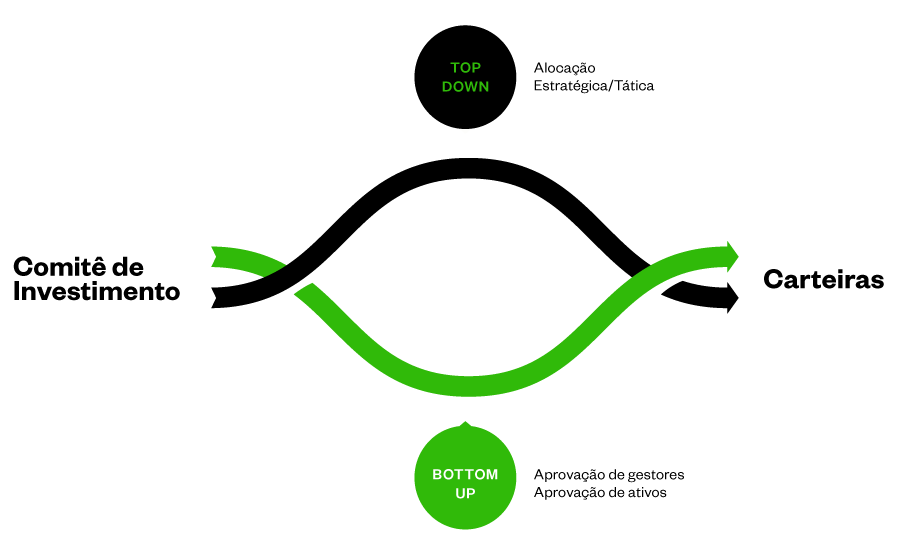

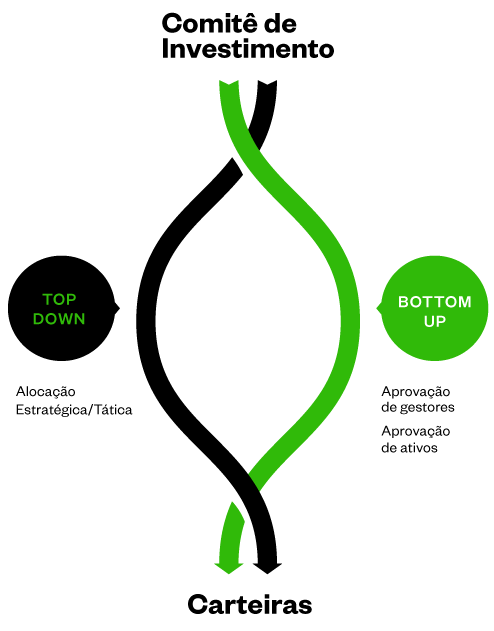

We follow a strict investment process:

There are three well-defined stages to carefully align the portfolio to client’s profile.

Investment Profile

We carry out a detailed analysis of our clients to generate a suitable and exclusive investment profile.

- Return Objective

- Risk tolerance

- Restrictions

Structure

We study the best structure for you and, because we are independent, we negotiate directly with service providers to optimize costs and processes.

Management

This is the stage where we use our core competence. It’s where our investment team analyzes scenarios and creates a balanced portfolio suited to the risks involved and your investment profile.

Investment

Committee

We bring together specialists from different areas who complement each other to take care of your wealth with diligence and competence. Our committee includes professionals with over 45 years of experience in asset management who know how to act in times of both optimism and market stress.

Customer

Relations

Looking after your wealth is too big a task for you to do alone. You can always count on the help of our Relationship Team.

Rio de Janeiro – RJ

R. Humaitá 275, 11th & 12th floors

Humaitá

Postal Code: 22261-005

Phone: +55 21 3528-8200

Guilherme Araujo

Tiago Iozzi

São Paulo – SP

Av. Brigadeiro Faria Lima, 2277

Unit 1904, 19th floor – Jd. Paulistano

Postal Code: 01452-000

Phone: +55 11 4878-0001